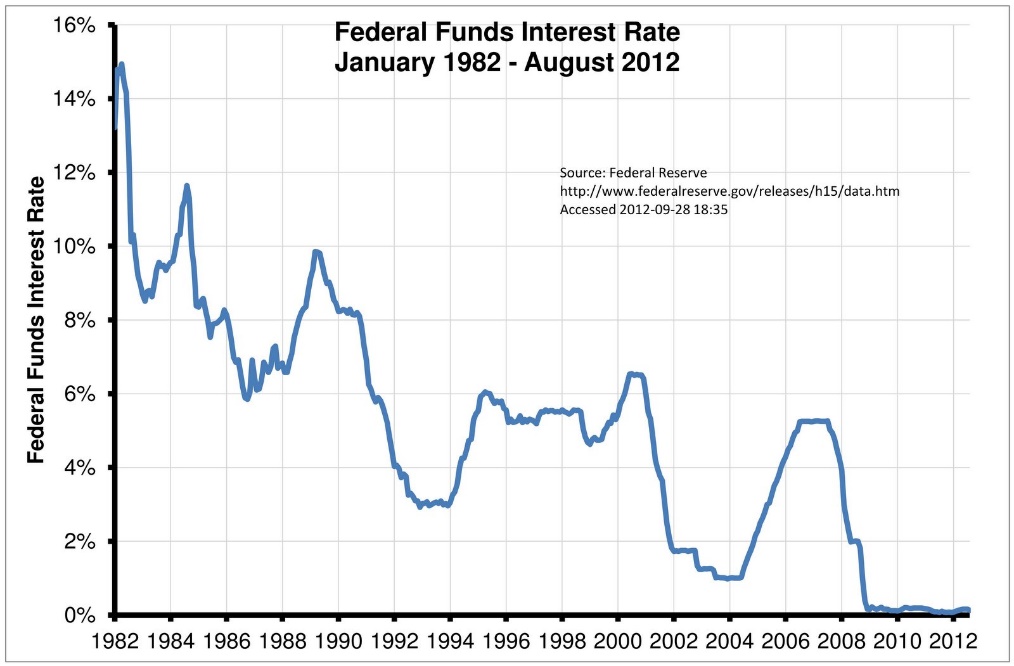

So through this, these open market operations, the Federal Reserve will be able to adjust that federal funds rate, or they'll be increasing it in response to that increase in the inflation rate. When there isnt as much to lend, banks will raise the fed funds rate. This pushes the fed funds rate lower, as the bank tries to unload this extra reserve. When the Fed increases a banks credit by buying up its securities, it gives the bank more fed funds to lend to other banks. So in order for them to do this, though, at least operationally, the Fed is going to adjust this federal funds rate through the use of open market operations, so that is there going to be buying or selling bonds and securities. Reuters reported that this action raised the short-term federal funds rate to a range of 1.5 percent to 1.75 percent, and Federal Reserve officials projected the rate to increase to 3.4 percent by the end of this year and to 3.8 percent in 2023 a substantial shift from projections in March that saw the rate rising to 1.9 percent this year. How Open-Market Operations Affect Interest Rates. And they're going to do this in sort of in an attempt to counteract this speeding up of the inflation rate or of the economy and this increase in the inflation rate. The bank has to keep a percentage of these new funds in reserve, but can lend the excess money to another bank in the federal funds market. When the Fed sells securities, bank reserves fall, and the.

The federal funds rate is the major tool that the Fed uses to conduct monetary policy in the United States. When the Fed buys securities, bank reserves rise, and the federal funds rate tends to fall. When the Fed wants to increase the federal funds rate, it does the reverse open-market operation of selling government securities to the banks. The Federal Reserve is likely going to increase the federal funds rate like we just said. That increase in the supply of available reserves causes the federal funds rate to decrease. Major interest rates charged on financial products, such as mortgages. And the reason for this is because when we see increases in the inflation rate, it's a sort of indication that the economy is starting to speed up or seeing it improves. A low federal funds rate is typically an expansionary monetary policy strategy to help strengthen the economy. Um, So when this inflation rate is increasing, we're also going to see an increase in the federal funds rate. Higher interest rates make loans more expensive for both businesses and. If there's an increase in the inflation rate, what's going to happen to the federal funds rate and quick review, what we know of the federal funds rate is that this is what banks are charging each other when it comes to overnight loans. Traders of interest rate futures still overwhelmingly expect the Fed to deliver a 75 basis point rate hike next month, and they expect rates to rise to a 3.25-3.5 range by year end, in line with. The Fed raised its benchmark rate by 3/4 point earlier this month to a range of 1.5 to 1.75 in response to the highest U.S. When the Fed raises the federal funds target rate, the goal is to increase the cost of credit throughout the economy.

0 kommentar(er)

0 kommentar(er)